Home »

Find a local name you can trust. Right at our doorstep—right here in your neighborhood.

We are proud to serve hometowns throughout Iowa.

With a legacy spanning back to 1926, our family-owned and operated independent insurance agency takes great pride in serving the residents of rural small-town Iowa. We offer a range of insurance products to cover the needs of our neighbors. At our agency, we hold true to the principles of small-town values, assuring you that honesty and integrity are at the forefront of everything we do. We take immense pride in these values, as they form the solid foundation upon which our agency is built.

Our history.

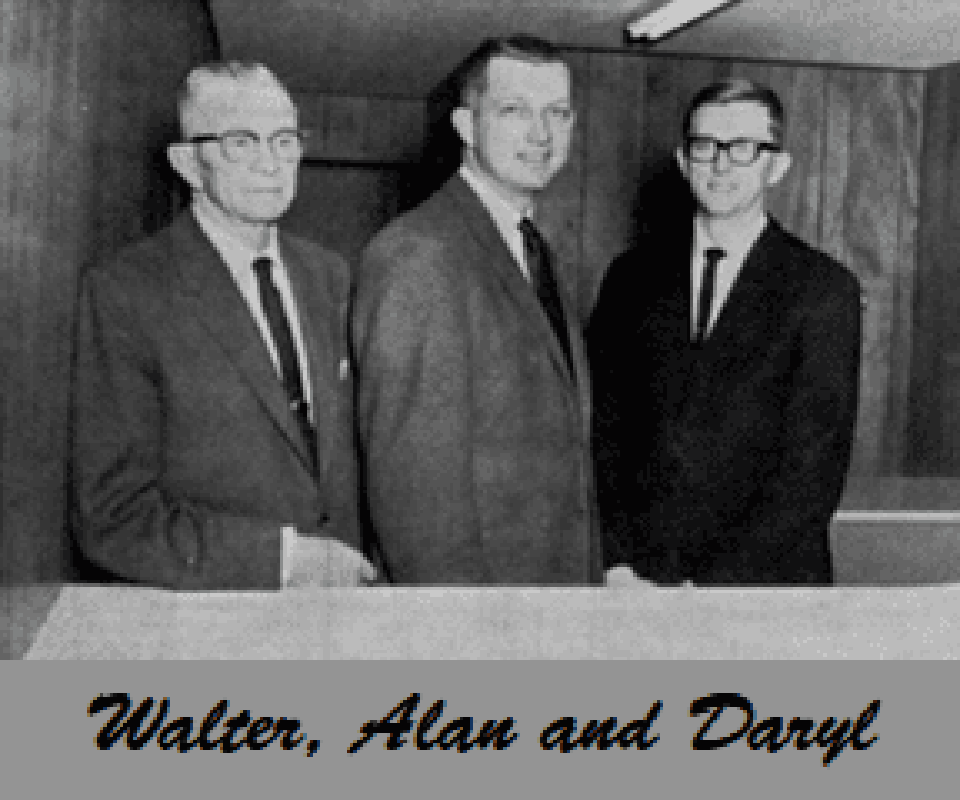

The roots of our agency can be traced to Walter R. Johnson and his wife Ruby, who established their insurance business in their farmhouse southeast of Ogden, Iowa. Walter’s personal pocket record book became the repository of customer interactions and business transactions, while Ruby diligently handled payment collection and bookkeeping. As time passed, their sons Alan and Daryl joined the agency, leading to the relocation of our office to West Walnut Street in Ogden.

With each passing year, our agency expanded its reach, opening offices in Dayton and Boone, Iowa. Today, we continue the tradition of building strong relationships with our customers, upholding the legacy of family and staff engagement that Walter and Ruby instilled way back then.

Our Team Has Your Back

We specialize in a variety of coverage options to meet your unique insurance needs.

Our Mission

At Johnson & Sons, Inc., we take pride in being your trusted neighborhood independent insurance agency, and we’re here to protect what you care about most. Choose from a variety of insurance companies and plans that meet your budget—all with an unbiased, licensed team here to be your guide.

3

20

97

Insurance Designed for Your Needs

Johnson & Sons, Inc. is located in Ogden, IA, Dayton, IA, and Boone, IA, and licensed in Iowa.

Let’s Get Started

Request an Insurance Quote

"*" indicates required fields

Don’t like forms? Contact us at 515-275-2977 or email us.